Discover Secured Credit Card Build Your Credit History

A real credit card with no annual fee plus earn cashback on purchases. See terms and apply for secured credit card today. Annual Fee: None.x% standard variable purchase APR. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by and up to x% fee for future balance transfers will apply. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

If you are building a credit history, or looking to rebuild with credit responsible use , the Discover it® Secured Credit Card may be right for you.2 To see if you qualify for a secured credit card, Discover reviews your application, credit report and other information.

You will need to be at least 18 years of age, have a Social security number, U.S. address and U.S. bank account, and provide all the required information in the online application. Be sure to have your bank routing number and account number handy when you apply. Applications are taken 24X7 on Discover.com. Apply Now

A secured credit card requires you to make a deposit equal to the amount of your credit line, while an unsecured credit card requires no deposit.

A secured credit card is designed for people who are looking to build or rebuild their credit. It looks and acts like a traditional credit card except that you provide a security deposit as collateral for your credit card account.1 Your credit line will equal the amount of this security deposit. And like a traditional credit card, as you use your credit card, you will need to make payments each month and your credit card account use is reported to the three major credit bureaus. So your on-time payments and responsible use can help build your credit.2 Starting seven months after you’ve been a secured credit card member, we’ll review your account monthly to see if we can return your security deposit while you continue to enjoy your card benefits.3 These reviews will look for your responsible credit use across all your cards and loans, not just with Discover. Apply Now.

1. If you pay your balance in full and close your credit card account, we’ll refund your security deposit, which can take up to two billing cycles plus ten days. 2. After 7 months, we begin automatic monthly account reviews to see if you qualify to upgrade to an ‘unsecured’ card and get your deposit back.3 These reviews are based on responsible credit management across all of your credit cards and loans, including Discover and others.

Yes. Getting a secured credit card isn’t guaranteed. Your application can be turned down.

A secured credit card reports your credit history to the major credit bureaus like other credit cards. So your continued responsible credit use can help you build a more appealing credit history over time.2 How long it takes to get the credit score you want depends on where you’re starting and how you use your secured credit card, as well as other credit accounts and loans. With the Discover it Secured Credit Card, automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.3

Your APR—or annual percentage rate—on a secured credit card is a statement of the interest rate as a yearly rate. Let’s say you started a new term and charged $500 for books, with an 18% APR. If you never made any payments over the 12 months, you would owe an extra $90 annually.

Discover requires a minimum deposit of $200 to open a secured credit card account, but you can choose a larger deposit amount up to $2,500 if you’re approved for it.1 When you’re using your secured credit card to build a credit history, you need a credit limit that lets you easily make regular purchases and pay your bill responsibly.

Yes, a credit card issuer will place a hard inquiry on your credit report when you apply for a new secured card, just as they would for an unsecured credit card application.

This card is for people new to credit as well as people looking to rebuild their credit. To determine if you qualify for an account, we review the information that you provide on the application, information in your credit report, as well as other information we may have about your creditworthiness. If you are not approved, we will provide you with the score we obtained, which credit reporting agency it was obtained from, and the reasons we could not approve your application.

Some secured credit cards can help you build or rebuild credit if used responsibly. For example, the Discover it® Secured credit card can help you build your credit if you responsibly use your account and pay your other loans on time.2 Be sure to make at least your minimum monthly payment due on time. It may also help to pay down existing credit card debt and dispute errors on your credit report. Apply for a Discover it® Secured card to begin building your credit with responsible use today. Annual Fee: None.x% standard variable purchase APR. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by and up to x% fee for future balance transfers will apply. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

FAQ

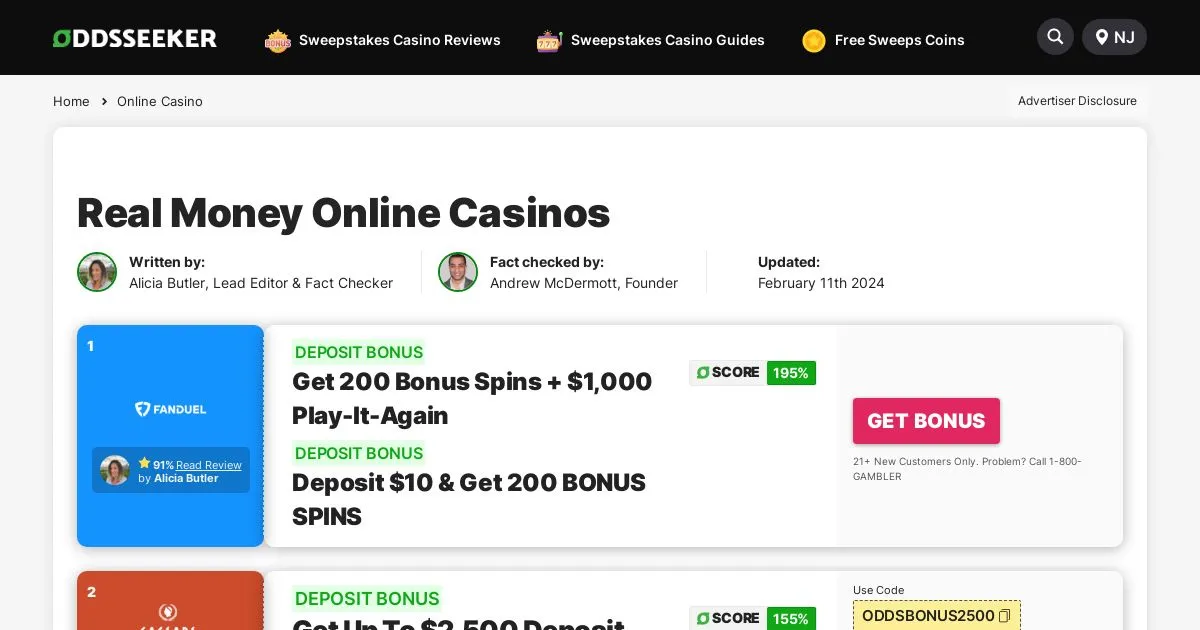

What casino has a real no deposit bonus?

Prepare for a no deposit bonus worth $100 free chip from Yabby Casino! This bonus is available on registration and involves inputting the GRAND100 bonus code. Satisfying the 45x wagering requirements will allow you to withdraw a sum up to $100. Yabby Casino’s terms and conditions apply.

What is the best online real money casino with no-deposit bonus?

Free slot sites are often social casinos that offer free slot games without players having to wager real money. However, these websites are typically not licensed, so players cannot win any real money from playing these free slots.

Which game pays real money without deposit?

Free spins casinos are great for slot players, giving them a chance to try out new games at no expense and even win money. Top free spins casinos like FanDuel and BetMGM invite players to start trying slots right away without even having to deposit first.

Which online casino has the biggest welcome bonus no deposit?

Use the offer code 300FREE when you register at Silveredge Casino to receive $300 as a no deposit bonus. The wagering requirements for the promotion are 20x for slots and 50x for video poker and table games. The maximum cashout is 10 times the deposit amount. Silveredge Casino’s terms and conditions apply.

What is the best online real money casino with no-deposit bonus?

Free slot sites are often social casinos that offer free slot games without players having to wager real money. However, these websites are typically not licensed, so players cannot win any real money from playing these free slots.

This site only collects related articles. Viewing the original, please copy and open the following link:Discover Secured Credit Card Build Your Credit History